BitCoin; Ford job cut

Bitcoin in the coming age of under-regulation

“Bitcoin’s shift towards respectability should concern us all”

- Recent crypto booms reflect less of institutional validation and more of profit squeezing. So, “[t]his is the era of institutional crypto capture.”

“bitcoin, conceived as a peer-to-peer electronic cash system that would eliminate the need for financial intermediaries, is now primarily traded through funds managed by the very intermediaries it was meant to circumvent.”

The … embrace of crypto is less a validation of its alleged revolutionary potential and more an attempt to extract fees from what is, essentially, gambling. It has effectively neutered crypto’s radical promise of disintermediation.

- But the guardrails aren’t set. Instead, asset managers are increasingly pressured to include crypto in the portfolio.

Ford Job Cut in Europe

“Ford to cut 4,000 jobs in Europe”

The job cut reflects the pressure coming from slowing growth of EVs as well as the competition with China. This is not new. Ford has struggled in Europe for quite a long time.

Vokswagen similarly plans to close three plants in Germany.

The transition to EV itself also requires less labor.

Goldman Sachs and/in China

“Inside Goldman Sachs’ years-long power struggle over its China venture”

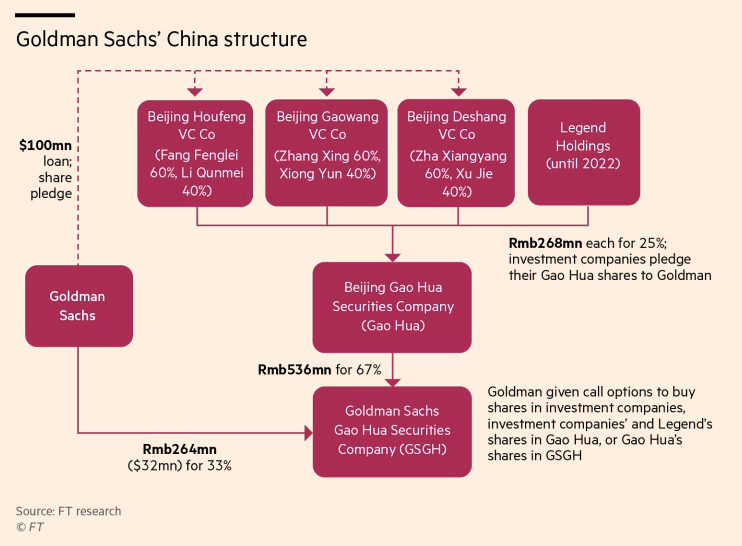

Fang Fenglei, Goldman Sachs’ early partner in China who was mentored by Wang Qishan, “wove himself into the fabric of the bank’s Chinese operations and forced it to pay far more than it had expected to gain full ownership of the business.”

The story is indicative of how difficult it is for even a finance giant like GS to operate in China against a local partner who is a real insider.

Wang Qishan eventually became Xi Jinping’s anti-corruption Czar.

Fang was involved in GS’s operations in China through the joint venture, Gao Hua, and vice versa.

- The breaking point was when China raised the cap on foreign ownership. GS wanted a new arrangement where Fang had marginal profits. But Fang wanted a new deal that can deliver a bonanza for him. GS couldn’t find an alternative partner as well connected to CCP as Fang. Lengthy negotiations ensued.

Eventually Fang retained the full control of Gao Hua. Dividens did not go to GS.

Goldman eventually ‘bought back’ Gao Hua and its related operations.