job market; venture capital; exploding pagers; rate cut expectations

White collar nob market mismatch

“Blanked or rejected: is finding a job harder than ever?”

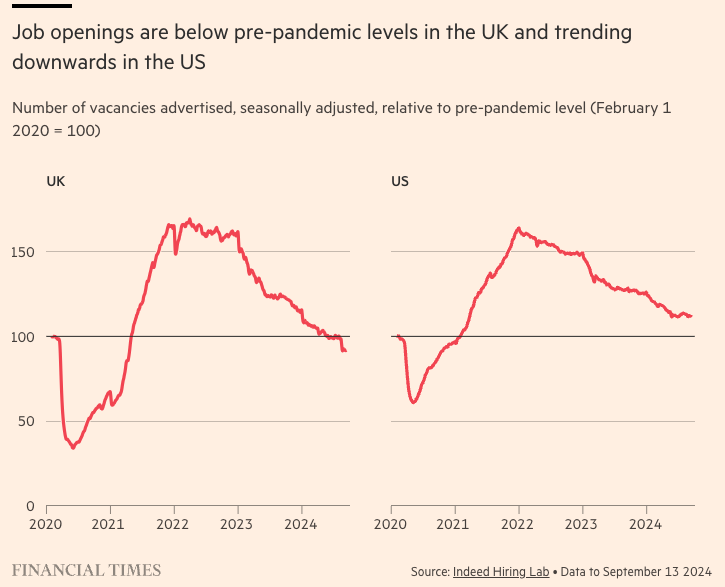

Numerous applications (more than 100) still don’t seem to lead to good results. The pandemic surge in labor demand is now gone, though unemployment rates are generally low.

- “Now openings are only 12 per cent above pre-pandemic levels in the US and 8 per cent below in the UK.”

Interests rate hikes “curbed employers’ ability to invest in hiring.”

The problem, however, is that the employers are “still struggling to find quality candidates among the deluge.”

one reason is AI tailors CVs so good that most of them look good.

anxious applicants put in more applications (“spray and pray” approach), triggering a vicious cycle. Companies also cut back hiring budgets and recruiters have a hard time reviewing all applicants.

another area of mismatch is between the blue- and white-collar jobs. Demand for the former is much stronger than the latter.

Steve Cohen

“Steve Cohen to step back from trading at hedge fund Point72”

“Steve Cohen, the billionaire founder of US hedge fund Point72, is stepping back from trading to focus on running the firm he founded a decade ago.”

Point72 is unique, in that “[u]nlike a traditional hedge fund that might trade one or two strategies in one asset class, Point72 has hundreds of investment staff across 185 teams around the world, focusing on a variety of trading strategies in equities, macro and computer-driven trading.”

One reason seems to be that Point72 became too successful and large.

Exploding pagers

“Exploding pagers join long history of killer communications devices”

Hizbolla was hit by Israel, through explosion of pagers, a communication medium that they prefer for simplicity and intractability.

Israeli attack through communication devices is nothing new.

How exactly it was conducted this time is not entirely clear.

Wall Street is betting on a big cut.

“Wall Street Has Its Eye on a Big Rate Cut”

update (2:30pm): Fed cut the rates by .5 FT link

S&P500 and many other stock market indices surged in the expectation of a big interest rate cut (to be determined today) by Fed.

Lately, there’s been some changes in the expectation: “The gains have come with traders in futures markets indicating that they think a half-point cut — even if an unusually big move — is the most likely outcome on Wednesday. That’s a big shift in thinking from just a few weeks ago.”

But if a big cut is read by the market as a sign of a pending recession, the consequence would be dire.

- hence the caution: “There are some signs of caution among investors. The gains in recent weeks have been led by real estate and utilities, with the former seen as a primary beneficiary of lower rates and the latter a more defensive bet as the economy slows. The technology stocks that led the market rally for so many years have slipped over the past month.”