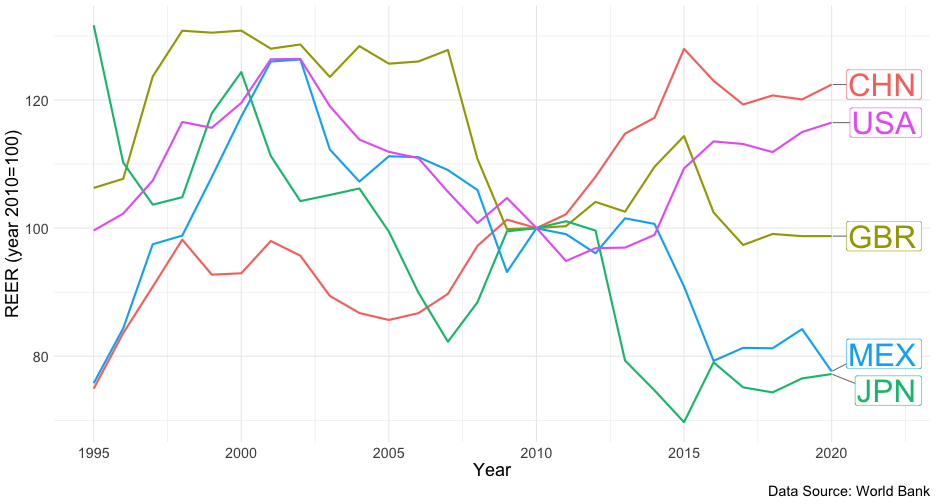

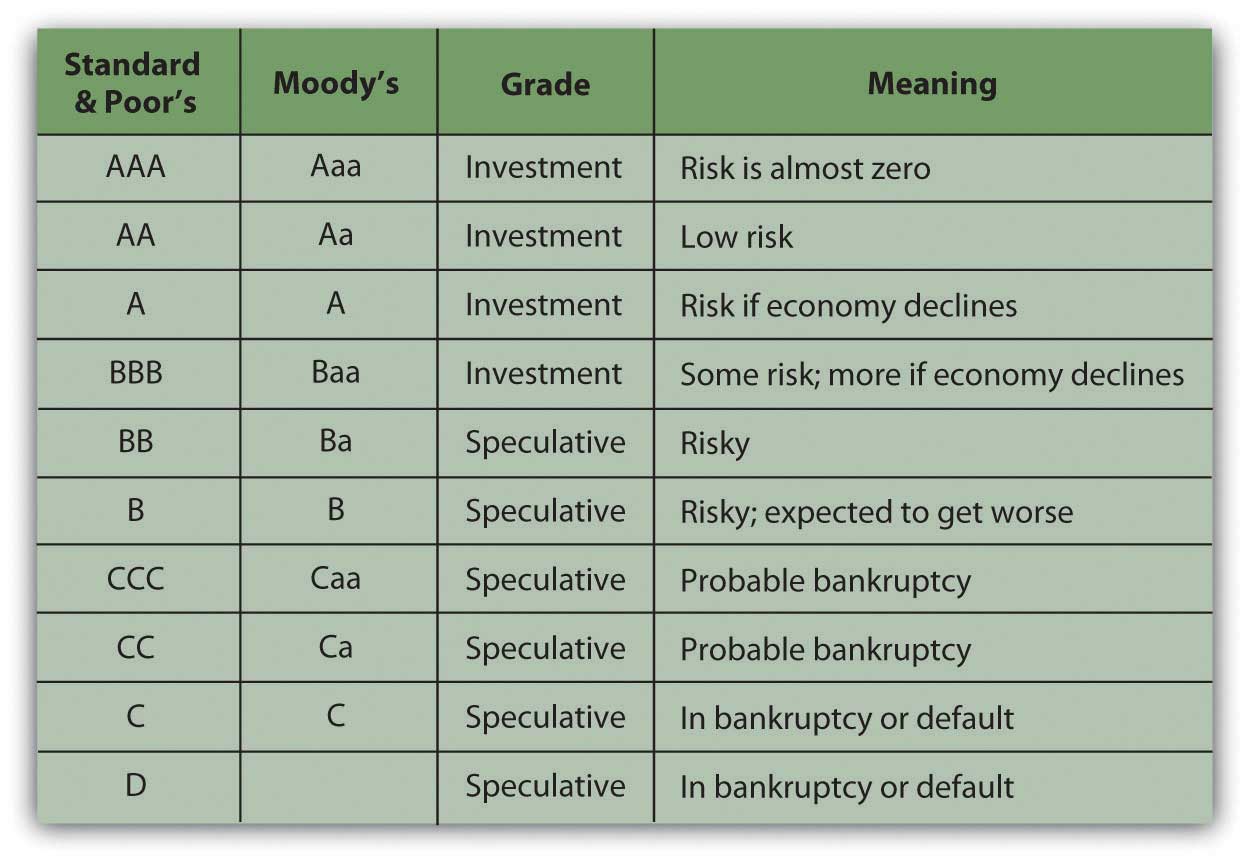

class: top, left, middle background-image: url(https://media0.giphy.com/media/cJFQJzZxFMhONxDTnt/200w.gif?cid=6c09b952ib6bxzy74li8lofynkhfmhqaue0rgolki8u9afeg&ep=v1_gifs_search&rid=200w.gif&ct=g) background-size: 60% background-position: right # .huge[.Blue[**Global <br> .hl3[Finance]**]] <br><br> GLOA 610 --- class: inverse background-color: black background-image: url(https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcSm8iyhqitY7a6JP3AyfNXCxPzZGc6GM4DvPA&usqp=CAU) background-size: contain background-position: right ## .Large[Three Areas of Global 'Finance'] -- ## 1) Currency Exchanges (exchange rates) <br>: $7.5 tn .yellow[per day] (as of 2022) <br> <svg aria-hidden="true" role="img" viewBox="0 0 512 512" style="height:1em;width:1em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:green;overflow:visible;position:relative;"><path d="M448 128l-177.6 0c1 5.2 1.6 10.5 1.6 16l0 16 32 0 144 0c8.8 0 16-7.2 16-16s-7.2-16-16-16zM224 144c0-17.7-14.3-32-32-32c0 0 0 0 0 0l-24 0c-66.3 0-120 53.7-120 120l0 48c0 52.5 33.7 97.1 80.7 113.4c-.5-3.1-.7-6.2-.7-9.4c0-20 9.2-37.9 23.6-49.7c-4.9-9-7.6-19.4-7.6-30.3c0-15.1 5.3-29 14-40c-8.8-11-14-24.9-14-40l0-40c0-13.3 10.7-24 24-24s24 10.7 24 24l0 40c0 8.8 7.2 16 16 16s16-7.2 16-16l0-40 0-40zM192 64s0 0 0 0c18 0 34.6 6 48 16l208 0c35.3 0 64 28.7 64 64s-28.7 64-64 64l-82 0c1.3 5.1 2 10.5 2 16c0 25.3-14.7 47.2-36 57.6c2.6 7 4 14.5 4 22.4c0 20-9.2 37.9-23.6 49.7c4.9 9 7.6 19.4 7.6 30.3c0 35.3-28.7 64-64 64l-64 0-24 0C75.2 448 0 372.8 0 280l0-48C0 139.2 75.2 64 168 64l24 0zm64 336c8.8 0 16-7.2 16-16s-7.2-16-16-16l-48 0-16 0c-8.8 0-16 7.2-16 16s7.2 16 16 16l64 0zm16-176c0 5.5-.7 10.9-2 16l2 0 32 0c8.8 0 16-7.2 16-16s-7.2-16-16-16l-32 0 0 16zm-24 64l-40 0c-8.8 0-16 7.2-16 16s7.2 16 16 16l48 0 16 0c8.8 0 16-7.2 16-16s-7.2-16-16-16l-24 0z"/></svg> $1tn, if only counting over-the-counter -- ## 2) Debt ($230 tn in 2023) -- ## 3) Other types of money flow <br> (e.g., remittances: $860 bn in 2023) --- class: inverse, bottom, right background-color: #37145A background-image: url(https://media.giphy.com/media/3oz8xMrLEYDnoHLbCE/giphy.gif) background-size: contain # .yellow[.Huge[First, Exchange Rates]] --- background-image: url(https://cdn.britannica.com/13/145313-050-852A6F13/Exchange-rates-Suvarnabhumi-International-Airport-Thai-Bangkok.jpg) background-position: right background-size: 30% ## **Exchange rates** -- ### = value of a currency compared to another's <br> = the .green[price] of a currency -- ### 1. .orange[nominal] exchange rates - .large[need to know when travel abroad <svg aria-hidden="true" role="img" viewBox="0 0 576 512" style="height:1em;width:1.12em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M482.3 192c34.2 0 93.7 29 93.7 64c0 36-59.5 64-93.7 64l-116.6 0L265.2 495.9c-5.7 10-16.3 16.1-27.8 16.1l-56.2 0c-10.6 0-18.3-10.2-15.4-20.4l49-171.6L112 320 68.8 377.6c-3 4-7.8 6.4-12.8 6.4l-42 0c-7.8 0-14-6.3-14-14c0-1.3 .2-2.6 .5-3.9L32 256 .5 145.9c-.4-1.3-.5-2.6-.5-3.9c0-7.8 6.3-14 14-14l42 0c5 0 9.8 2.4 12.8 6.4L112 192l102.9 0-49-171.6C162.9 10.2 170.6 0 181.2 0l56.2 0c11.5 0 22.1 6.2 27.8 16.1L365.7 192l116.6 0z"/></svg> : a-/depreciate)] - .large[instantaneously available] -- ### 2. .red[real] exchange rates - .large[.pink[actual] costs of things] - .large[estimates] (smaller or large than .blue[1]) - .large[nominal] ** `\(\times\)` ** .large[inflation rates: .purple[**under**]/.Blue[**over**]valued] -- ### overall, considered an indicator of .pink[competitiveness] --- # .large[But, what competitiveness?] -- ## : the .red[price] competitiveness of .green[tradables] -- ## .red[under]valuation: good for exports ('beggar-thy-neighbor') -- .pull-left[ .content-box-yellow[.Large[ ## importing a BMW <svg aria-hidden="true" role="img" viewBox="0 0 512 512" style="height:1em;width:1em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M135.2 117.4L109.1 192H402.9l-26.1-74.6C372.3 104.6 360.2 96 346.6 96H165.4c-13.6 0-25.7 8.6-30.2 21.4zM39.6 196.8L74.8 96.3C88.3 57.8 124.6 32 165.4 32H346.6c40.8 0 77.1 25.8 90.6 64.3l35.2 100.5c23.2 9.6 39.6 32.5 39.6 59.2V400v48c0 17.7-14.3 32-32 32H448c-17.7 0-32-14.3-32-32V400H96v48c0 17.7-14.3 32-32 32H32c-17.7 0-32-14.3-32-32V400 256c0-26.7 16.4-49.6 39.6-59.2zM128 288a32 32 0 1 0 -64 0 32 32 0 1 0 64 0zm288 32a32 32 0 1 0 0-64 32 32 0 1 0 0 64z"/></svg> - <svg aria-hidden="true" role="img" viewBox="0 0 320 512" style="height:1em;width:0.62em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M48.1 240c-.1 2.7-.1 5.3-.1 8v16c0 2.7 0 5.3 .1 8H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H60.3C89.9 419.9 170 480 264 480h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264c-57.9 0-108.2-32.4-133.9-80H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H112.2c-.1-2.6-.2-5.3-.2-8V248c0-2.7 .1-5.4 .2-8H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H130.1c25.7-47.6 76-80 133.9-80h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264C170 32 89.9 92.1 60.3 176H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H48.1z"/></svg> 1 = <svg aria-hidden="true" role="img" viewBox="0 0 320 512" style="height:1em;width:0.62em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M160 0c17.7 0 32 14.3 32 32V67.7c1.6 .2 3.1 .4 4.7 .7c.4 .1 .7 .1 1.1 .2l48 8.8c17.4 3.2 28.9 19.9 25.7 37.2s-19.9 28.9-37.2 25.7l-47.5-8.7c-31.3-4.6-58.9-1.5-78.3 6.2s-27.2 18.3-29 28.1c-2 10.7-.5 16.7 1.2 20.4c1.8 3.9 5.5 8.3 12.8 13.2c16.3 10.7 41.3 17.7 73.7 26.3l2.9 .8c28.6 7.6 63.6 16.8 89.6 33.8c14.2 9.3 27.6 21.9 35.9 39.5c8.5 17.9 10.3 37.9 6.4 59.2c-6.9 38-33.1 63.4-65.6 76.7c-13.7 5.6-28.6 9.2-44.4 11V480c0 17.7-14.3 32-32 32s-32-14.3-32-32V445.1c-.4-.1-.9-.1-1.3-.2l-.2 0 0 0c-24.4-3.8-64.5-14.3-91.5-26.3c-16.1-7.2-23.4-26.1-16.2-42.2s26.1-23.4 42.2-16.2c20.9 9.3 55.3 18.5 75.2 21.6c31.9 4.7 58.2 2 76-5.3c16.9-6.9 24.6-16.9 26.8-28.9c1.9-10.6 .4-16.7-1.3-20.4c-1.9-4-5.6-8.4-13-13.3c-16.4-10.7-41.5-17.7-74-26.3l-2.8-.7 0 0C119.4 279.3 84.4 270 58.4 253c-14.2-9.3-27.5-22-35.8-39.6c-8.4-17.9-10.1-37.9-6.1-59.2C23.7 116 52.3 91.2 84.8 78.3c13.3-5.3 27.9-8.9 43.2-11V32c0-17.7 14.3-32 32-32z"/></svg> 1 - <svg aria-hidden="true" role="img" viewBox="0 0 320 512" style="height:1em;width:0.62em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M48.1 240c-.1 2.7-.1 5.3-.1 8v16c0 2.7 0 5.3 .1 8H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H60.3C89.9 419.9 170 480 264 480h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264c-57.9 0-108.2-32.4-133.9-80H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H112.2c-.1-2.6-.2-5.3-.2-8V248c0-2.7 .1-5.4 .2-8H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H130.1c25.7-47.6 76-80 133.9-80h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264C170 32 89.9 92.1 60.3 176H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H48.1z"/></svg> 50k ⇒ <svg aria-hidden="true" role="img" viewBox="0 0 320 512" style="height:1em;width:0.62em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M160 0c17.7 0 32 14.3 32 32V67.7c1.6 .2 3.1 .4 4.7 .7c.4 .1 .7 .1 1.1 .2l48 8.8c17.4 3.2 28.9 19.9 25.7 37.2s-19.9 28.9-37.2 25.7l-47.5-8.7c-31.3-4.6-58.9-1.5-78.3 6.2s-27.2 18.3-29 28.1c-2 10.7-.5 16.7 1.2 20.4c1.8 3.9 5.5 8.3 12.8 13.2c16.3 10.7 41.3 17.7 73.7 26.3l2.9 .8c28.6 7.6 63.6 16.8 89.6 33.8c14.2 9.3 27.6 21.9 35.9 39.5c8.5 17.9 10.3 37.9 6.4 59.2c-6.9 38-33.1 63.4-65.6 76.7c-13.7 5.6-28.6 9.2-44.4 11V480c0 17.7-14.3 32-32 32s-32-14.3-32-32V445.1c-.4-.1-.9-.1-1.3-.2l-.2 0 0 0c-24.4-3.8-64.5-14.3-91.5-26.3c-16.1-7.2-23.4-26.1-16.2-42.2s26.1-23.4 42.2-16.2c20.9 9.3 55.3 18.5 75.2 21.6c31.9 4.7 58.2 2 76-5.3c16.9-6.9 24.6-16.9 26.8-28.9c1.9-10.6 .4-16.7-1.3-20.4c-1.9-4-5.6-8.4-13-13.3c-16.4-10.7-41.5-17.7-74-26.3l-2.8-.7 0 0C119.4 279.3 84.4 270 58.4 253c-14.2-9.3-27.5-22-35.8-39.6c-8.4-17.9-10.1-37.9-6.1-59.2C23.7 116 52.3 91.2 84.8 78.3c13.3-5.3 27.9-8.9 43.2-11V32c0-17.7 14.3-32 32-32z"/></svg> 50k - amount paid to BMW: <svg aria-hidden="true" role="img" viewBox="0 0 320 512" style="height:1em;width:0.62em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M48.1 240c-.1 2.7-.1 5.3-.1 8v16c0 2.7 0 5.3 .1 8H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H60.3C89.9 419.9 170 480 264 480h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264c-57.9 0-108.2-32.4-133.9-80H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H112.2c-.1-2.6-.2-5.3-.2-8V248c0-2.7 .1-5.4 .2-8H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H130.1c25.7-47.6 76-80 133.9-80h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264C170 32 89.9 92.1 60.3 176H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H48.1z"/></svg> 50k ] ] ] -- .pull-right[ .content-box-red[.Large[ ## importing a BMW <svg aria-hidden="true" role="img" viewBox="0 0 512 512" style="height:1em;width:1em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M135.2 117.4L109.1 192H402.9l-26.1-74.6C372.3 104.6 360.2 96 346.6 96H165.4c-13.6 0-25.7 8.6-30.2 21.4zM39.6 196.8L74.8 96.3C88.3 57.8 124.6 32 165.4 32H346.6c40.8 0 77.1 25.8 90.6 64.3l35.2 100.5c23.2 9.6 39.6 32.5 39.6 59.2V400v48c0 17.7-14.3 32-32 32H448c-17.7 0-32-14.3-32-32V400H96v48c0 17.7-14.3 32-32 32H32c-17.7 0-32-14.3-32-32V400 256c0-26.7 16.4-49.6 39.6-59.2zM128 288a32 32 0 1 0 -64 0 32 32 0 1 0 64 0zm288 32a32 32 0 1 0 0-64 32 32 0 1 0 0 64z"/></svg> - <svg aria-hidden="true" role="img" viewBox="0 0 320 512" style="height:1em;width:0.62em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M48.1 240c-.1 2.7-.1 5.3-.1 8v16c0 2.7 0 5.3 .1 8H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H60.3C89.9 419.9 170 480 264 480h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264c-57.9 0-108.2-32.4-133.9-80H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H112.2c-.1-2.6-.2-5.3-.2-8V248c0-2.7 .1-5.4 .2-8H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H130.1c25.7-47.6 76-80 133.9-80h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264C170 32 89.9 92.1 60.3 176H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H48.1z"/></svg> .red[2] = <svg aria-hidden="true" role="img" viewBox="0 0 320 512" style="height:1em;width:0.62em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M160 0c17.7 0 32 14.3 32 32V67.7c1.6 .2 3.1 .4 4.7 .7c.4 .1 .7 .1 1.1 .2l48 8.8c17.4 3.2 28.9 19.9 25.7 37.2s-19.9 28.9-37.2 25.7l-47.5-8.7c-31.3-4.6-58.9-1.5-78.3 6.2s-27.2 18.3-29 28.1c-2 10.7-.5 16.7 1.2 20.4c1.8 3.9 5.5 8.3 12.8 13.2c16.3 10.7 41.3 17.7 73.7 26.3l2.9 .8c28.6 7.6 63.6 16.8 89.6 33.8c14.2 9.3 27.6 21.9 35.9 39.5c8.5 17.9 10.3 37.9 6.4 59.2c-6.9 38-33.1 63.4-65.6 76.7c-13.7 5.6-28.6 9.2-44.4 11V480c0 17.7-14.3 32-32 32s-32-14.3-32-32V445.1c-.4-.1-.9-.1-1.3-.2l-.2 0 0 0c-24.4-3.8-64.5-14.3-91.5-26.3c-16.1-7.2-23.4-26.1-16.2-42.2s26.1-23.4 42.2-16.2c20.9 9.3 55.3 18.5 75.2 21.6c31.9 4.7 58.2 2 76-5.3c16.9-6.9 24.6-16.9 26.8-28.9c1.9-10.6 .4-16.7-1.3-20.4c-1.9-4-5.6-8.4-13-13.3c-16.4-10.7-41.5-17.7-74-26.3l-2.8-.7 0 0C119.4 279.3 84.4 270 58.4 253c-14.2-9.3-27.5-22-35.8-39.6c-8.4-17.9-10.1-37.9-6.1-59.2C23.7 116 52.3 91.2 84.8 78.3c13.3-5.3 27.9-8.9 43.2-11V32c0-17.7 14.3-32 32-32z"/></svg> 1 - <svg aria-hidden="true" role="img" viewBox="0 0 320 512" style="height:1em;width:0.62em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M48.1 240c-.1 2.7-.1 5.3-.1 8v16c0 2.7 0 5.3 .1 8H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H60.3C89.9 419.9 170 480 264 480h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264c-57.9 0-108.2-32.4-133.9-80H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H112.2c-.1-2.6-.2-5.3-.2-8V248c0-2.7 .1-5.4 .2-8H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H130.1c25.7-47.6 76-80 133.9-80h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264C170 32 89.9 92.1 60.3 176H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H48.1z"/></svg> 50k ⇒ <svg aria-hidden="true" role="img" viewBox="0 0 320 512" style="height:1em;width:0.62em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M160 0c17.7 0 32 14.3 32 32V67.7c1.6 .2 3.1 .4 4.7 .7c.4 .1 .7 .1 1.1 .2l48 8.8c17.4 3.2 28.9 19.9 25.7 37.2s-19.9 28.9-37.2 25.7l-47.5-8.7c-31.3-4.6-58.9-1.5-78.3 6.2s-27.2 18.3-29 28.1c-2 10.7-.5 16.7 1.2 20.4c1.8 3.9 5.5 8.3 12.8 13.2c16.3 10.7 41.3 17.7 73.7 26.3l2.9 .8c28.6 7.6 63.6 16.8 89.6 33.8c14.2 9.3 27.6 21.9 35.9 39.5c8.5 17.9 10.3 37.9 6.4 59.2c-6.9 38-33.1 63.4-65.6 76.7c-13.7 5.6-28.6 9.2-44.4 11V480c0 17.7-14.3 32-32 32s-32-14.3-32-32V445.1c-.4-.1-.9-.1-1.3-.2l-.2 0 0 0c-24.4-3.8-64.5-14.3-91.5-26.3c-16.1-7.2-23.4-26.1-16.2-42.2s26.1-23.4 42.2-16.2c20.9 9.3 55.3 18.5 75.2 21.6c31.9 4.7 58.2 2 76-5.3c16.9-6.9 24.6-16.9 26.8-28.9c1.9-10.6 .4-16.7-1.3-20.4c-1.9-4-5.6-8.4-13-13.3c-16.4-10.7-41.5-17.7-74-26.3l-2.8-.7 0 0C119.4 279.3 84.4 270 58.4 253c-14.2-9.3-27.5-22-35.8-39.6c-8.4-17.9-10.1-37.9-6.1-59.2C23.7 116 52.3 91.2 84.8 78.3c13.3-5.3 27.9-8.9 43.2-11V32c0-17.7 14.3-32 32-32z"/></svg> 25k: sales <svg aria-hidden="true" role="img" viewBox="0 0 384 512" style="height:1em;width:0.75em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M350 177.5c3.8-8.8 2-19-4.6-26l-136-144C204.9 2.7 198.6 0 192 0s-12.9 2.7-17.4 7.5l-136 144c-6.6 7-8.4 17.2-4.6 26s12.5 14.5 22 14.5h88l0 192c0 17.7-14.3 32-32 32H32c-17.7 0-32 14.3-32 32v32c0 17.7 14.3 32 32 32l80 0c70.7 0 128-57.3 128-128l0-192h88c9.6 0 18.2-5.7 22-14.5z"/></svg> - amount paid to BMW: <svg aria-hidden="true" role="img" viewBox="0 0 320 512" style="height:1em;width:0.62em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M48.1 240c-.1 2.7-.1 5.3-.1 8v16c0 2.7 0 5.3 .1 8H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H60.3C89.9 419.9 170 480 264 480h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264c-57.9 0-108.2-32.4-133.9-80H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H112.2c-.1-2.6-.2-5.3-.2-8V248c0-2.7 .1-5.4 .2-8H256c17.7 0 32-14.3 32-32s-14.3-32-32-32H130.1c25.7-47.6 76-80 133.9-80h24c17.7 0 32-14.3 32-32s-14.3-32-32-32H264C170 32 89.9 92.1 60.3 176H32c-17.7 0-32 14.3-32 32s14.3 32 32 32H48.1z"/></svg> .red[50k] - *effect on US automakers?* ] ] ] --- # The empirical reality of .blue[strong]/.pink[weak] currency policies <br> .tiny[: real effective exchange rates (inflation adjusted exchange rate against major trade partners)] <!-- --> --- class: inverse background-color: #d64161 background-image: url(https://raw.githubusercontent.com/textvulture/textvulture.github.io/master/images/background_leftEmpty2.jpg) background-size: 140% # .large[The effect of undervaluation .Small[(.pink[weak] currency)]] -- ## - serious welfare/distributional effects -- ## - external consequences (cf. 'currency manipulator') -- ## - Only .hl1[some] groups would like that. -- ### <svg aria-hidden="true" role="img" viewBox="0 0 512 512" style="height:1em;width:1em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:purple;overflow:visible;position:relative;"><path d="M448 128l-177.6 0c1 5.2 1.6 10.5 1.6 16l0 16 32 0 144 0c8.8 0 16-7.2 16-16s-7.2-16-16-16zM224 144c0-17.7-14.3-32-32-32c0 0 0 0 0 0l-24 0c-66.3 0-120 53.7-120 120l0 48c0 52.5 33.7 97.1 80.7 113.4c-.5-3.1-.7-6.2-.7-9.4c0-20 9.2-37.9 23.6-49.7c-4.9-9-7.6-19.4-7.6-30.3c0-15.1 5.3-29 14-40c-8.8-11-14-24.9-14-40l0-40c0-13.3 10.7-24 24-24s24 10.7 24 24l0 40c0 8.8 7.2 16 16 16s16-7.2 16-16l0-40 0-40zM192 64s0 0 0 0c18 0 34.6 6 48 16l208 0c35.3 0 64 28.7 64 64s-28.7 64-64 64l-82 0c1.3 5.1 2 10.5 2 16c0 25.3-14.7 47.2-36 57.6c2.6 7 4 14.5 4 22.4c0 20-9.2 37.9-23.6 49.7c4.9 9 7.6 19.4 7.6 30.3c0 35.3-28.7 64-64 64l-64 0-24 0C75.2 448 0 372.8 0 280l0-48C0 139.2 75.2 64 168 64l24 0zm64 336c8.8 0 16-7.2 16-16s-7.2-16-16-16l-48 0-16 0c-8.8 0-16 7.2-16 16s7.2 16 16 16l64 0zm16-176c0 5.5-.7 10.9-2 16l2 0 32 0c8.8 0 16-7.2 16-16s-7.2-16-16-16l-32 0 0 16zm-24 64l-40 0c-8.8 0-16 7.2-16 16s7.2 16 16 16l48 0 16 0c8.8 0 16-7.2 16-16s-7.2-16-16-16l-24 0z"/></svg> .orange[interest groups] would lobby for undervaluation (.Green[sometimes]) -- # .pink[Broz and Werfel (2014)]; .bluey[Steinberg and Shih (2012)] --- class: inverse, center, middle background-color: #37145A background-image: url(https://raw.githubusercontent.com/textvulture/textvulture.github.io/master/images/forestBackground.jpg) background-size: 100% # .huge[Let's talk about Debt] ## And how it is related to development --- class: inverse, center, middle background-color: red # .Huge[Is Debt = Doom <svg aria-hidden="true" role="img" viewBox="0 0 512 512" style="height:1em;width:1em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:currentColor;overflow:visible;position:relative;"><path d="M416 398.9c58.5-41.1 96-104.1 96-174.9C512 100.3 397.4 0 256 0S0 100.3 0 224c0 70.7 37.5 133.8 96 174.9c0 .4 0 .7 0 1.1v64c0 26.5 21.5 48 48 48h48V464c0-8.8 7.2-16 16-16s16 7.2 16 16v48h64V464c0-8.8 7.2-16 16-16s16 7.2 16 16v48h48c26.5 0 48-21.5 48-48V400c0-.4 0-.7 0-1.1zM96 256a64 64 0 1 1 128 0A64 64 0 1 1 96 256zm256-64a64 64 0 1 1 0 128 64 64 0 1 1 0-128z"/></svg>?] -- # B/C, foreign debt = losing independence? -- # OMG, I remember we owe China *a lot* ! --- # A quick .hl2[cut-away]: The Story of American Debt -- .pull-left[ .center[ <img src="https://cdn.howmuch.net/articles/Foreign-Curency-Draft9-4ddb.png" width="95%" /> ] ] -- .pull-right[ .center[ <img src="https://wolfstreet.com/wp-content/uploads/2018/10/US-Treasury-holdings-TIC-pie-2018-08.png" width="95%" /> ] ] --- # Aren't people still saying the US <svg aria-hidden="true" role="img" viewBox="0 0 320 512" style="height:1em;width:0.62em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:green;overflow:visible;position:relative;"><path d="M160 0c17.7 0 32 14.3 32 32V67.7c1.6 .2 3.1 .4 4.7 .7c.4 .1 .7 .1 1.1 .2l48 8.8c17.4 3.2 28.9 19.9 25.7 37.2s-19.9 28.9-37.2 25.7l-47.5-8.7c-31.3-4.6-58.9-1.5-78.3 6.2s-27.2 18.3-29 28.1c-2 10.7-.5 16.7 1.2 20.4c1.8 3.9 5.5 8.3 12.8 13.2c16.3 10.7 41.3 17.7 73.7 26.3l2.9 .8c28.6 7.6 63.6 16.8 89.6 33.8c14.2 9.3 27.6 21.9 35.9 39.5c8.5 17.9 10.3 37.9 6.4 59.2c-6.9 38-33.1 63.4-65.6 76.7c-13.7 5.6-28.6 9.2-44.4 11V480c0 17.7-14.3 32-32 32s-32-14.3-32-32V445.1c-.4-.1-.9-.1-1.3-.2l-.2 0 0 0c-24.4-3.8-64.5-14.3-91.5-26.3c-16.1-7.2-23.4-26.1-16.2-42.2s26.1-23.4 42.2-16.2c20.9 9.3 55.3 18.5 75.2 21.6c31.9 4.7 58.2 2 76-5.3c16.9-6.9 24.6-16.9 26.8-28.9c1.9-10.6 .4-16.7-1.3-20.4c-1.9-4-5.6-8.4-13-13.3c-16.4-10.7-41.5-17.7-74-26.3l-2.8-.7 0 0C119.4 279.3 84.4 270 58.4 253c-14.2-9.3-27.5-22-35.8-39.6c-8.4-17.9-10.1-37.9-6.1-59.2C23.7 116 52.3 91.2 84.8 78.3c13.3-5.3 27.9-8.9 43.2-11V32c0-17.7 14.3-32 32-32z"/></svg> dominance is ending? -- .pull-left[ <!-- --> ] -- .pull-right[ <img src="https://pup-assets.imgix.net/onix/images/9780691168524.jpg" width="60%" style="display: block; margin: auto;" /> ] --- class: inverse background-color: #37145A # .Large[**But aren't .red[most] debts still bad?**] .pull-left[ ## - No: In particular, .red[sovereign debt]: sources of .green[development fund] ## - .red[Too much] sovereign debt spells trouble though (i.e., 'original sin') ## - the more you borrow, the harder it becomes to borrow (.yellow[credit rating]) ] -- .pull-right[ # Example: Moody's .center[ <!-- --> ] ] --- class: inverse, middle background-image: url(https://www.glabarre.com/item_images/5k%20us%20bond.jpg) background-size: contain background-position: right background-color: black -- # .huge[**How does .Green[bond] work?**] -- # .Blue[**.green[Domestic] vs. Foreign currency denomination?**] -- # .orange[**Ballard-Rosa, Mosely, and Wellhausen (2021)**] --- class: inverse, left, bottom background-image: url(https://miro.medium.com/max/1400/1*Z-htNgpOFMVwdQHWLMrZ2Q.gif) background-size: contain # .Large[Sometimes you just cannot repay the debt.] -- # You need a bailout: how does that work? -- # .yellow[.Large[Schneider and Tobin (2020)]] --- class: inverse, right background-image: url(https://content3.jdmagicbox.com/comp/hyderabad/f6/040pxx40.xx40.140124131631.x9f6/catalogue/star-global-currency-exchange-pvt-ltd-jubilee-hills-hyderabad-foreign-exchange-agents-49enny0.jpg?clr=3f273f) background-size: contain background-position: left background-color: black #.huge[**Remmitances**] -- ## <svg aria-hidden="true" role="img" viewBox="0 0 640 512" style="height:1em;width:1.25em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:yellow;overflow:visible;position:relative;"><path d="M384 32H512c17.7 0 32 14.3 32 32s-14.3 32-32 32H398.4c-5.2 25.8-22.9 47.1-46.4 57.3V448H512c17.7 0 32 14.3 32 32s-14.3 32-32 32H320 128c-17.7 0-32-14.3-32-32s14.3-32 32-32H288V153.3c-23.5-10.3-41.2-31.6-46.4-57.3H128c-17.7 0-32-14.3-32-32s14.3-32 32-32H256c14.6-19.4 37.8-32 64-32s49.4 12.6 64 32zm55.6 288H584.4L512 195.8 439.6 320zM512 416c-62.9 0-115.2-34-126-78.9c-2.6-11 1-22.3 6.7-32.1l95.2-163.2c5-8.6 14.2-13.8 24.1-13.8s19.1 5.3 24.1 13.8l95.2 163.2c5.7 9.8 9.3 21.1 6.7 32.1C627.2 382 574.9 416 512 416zM126.8 195.8L54.4 320H199.3L126.8 195.8zM.9 337.1c-2.6-11 1-22.3 6.7-32.1l95.2-163.2c5-8.6 14.2-13.8 24.1-13.8s19.1 5.3 24.1 13.8l95.2 163.2c5.7 9.8 9.3 21.1 6.7 32.1C242 382 189.7 416 126.8 416S11.7 382 .9 337.1z"/></svg> Debatable if it helps development -- ### financing vs. rent-seeking -- ## <svg aria-hidden="true" role="img" viewBox="0 0 576 512" style="height:1em;width:1.12em;vertical-align:-0.125em;margin-left:auto;margin-right:auto;font-size:inherit;fill:red;overflow:visible;position:relative;"><path d="M96 80c0-26.5 21.5-48 48-48H432c26.5 0 48 21.5 48 48V384H96V80zm313 47c-9.4-9.4-24.6-9.4-33.9 0l-111 111-47-47c-9.4-9.4-24.6-9.4-33.9 0s-9.4 24.6 0 33.9l64 64c9.4 9.4 24.6 9.4 33.9 0L409 161c9.4-9.4 9.4-24.6 0-33.9zM0 336c0-26.5 21.5-48 48-48H64V416H512V288h16c26.5 0 48 21.5 48 48v96c0 26.5-21.5 48-48 48H48c-26.5 0-48-21.5-48-48V336z"/></svg> But is there any other effect? -- ### Tertytchnaya et al. (2018)